Good News! RBI Cuts Repo Rate: The Reserve Bank of India (RBI) announced a significant reduction in the repo rate, the first in five years, bringing it down by 0.25% from 6.5% to 6.25%. This move is expected to provide relief to borrowers as loans could become cheaper and EMIs are likely to decrease.

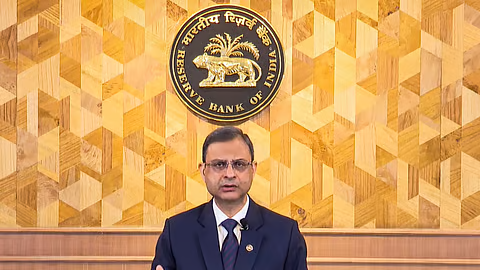

The announcement was made by RBI Governor Sanjay Malhotra during the Monetary Policy Committee (MPC) meeting on February 7. This decision reflects RBI’s effort to manage inflation and stimulate economic growth while easing the financial burden on citizens.

Table of Contents

RBI Cuts Repo Rate: What Does It Mean?

The repo rate is the interest rate at which RBI lends money to banks. When the repo rate is reduced, banks receive loans at a lower cost. This, in turn, enables banks to pass on the benefits to their customers by reducing interest rates on loans.

- Impact on Loans: Cheaper loans for new borrowers and a reduction in EMIs for those with floating interest rate loans.

- Timeline: Banks typically take 1-2 months to implement lower rates for their customers.

RBI Cuts Repo Rate: How Will EMI Be Affected?

EMI reductions depend on the type of loan:

| Loan Type | Impact of Repo Rate Cut |

|---|---|

| Fixed Interest Rate | No impact; interest rate remains unchanged. |

| Floating Interest Rate | EMI will decrease as interest rates reduce. |

Borrowers with floating-rate loans will see a direct benefit, while those with fixed-rate loans will not experience any changes.

RBI Cuts Repo Rate: Why Did RBI take this decesion?

The RBI cited a decline in inflation as the primary reason for the rate cut. According to Governor Sanjay Malhotra, inflation is expected to remain within the target range of 2%-6% and may reduce further in FY 2025-26.

Inflation Figures:

| Month | Retail Inflation (%) | Wholesale Inflation (%) |

|---|---|---|

| August 2024 | 3.65 | – |

| November 2024 | 5.48 | 1.89 |

| December 2024 | 5.22 | 3.36 |

Malhotra also highlighted that food inflation is expected to soften with the arrival of new crops, which will bring further relief.

Repo Rate History

The last repo rate cut was in May 2020, when the rate was reduced by 0.40%, bringing it down to 4%. However, between May 2022 and May 2023, the RBI increased the repo rate by 2.50%, reaching 6.5% to curb inflation.

| Date | Repo Rate (%) |

|---|---|

| May 2020 | 4.00 |

| May 2022 | 6.50 |

| February 2025 | 6.25 |

This reduction marks a significant change after years of consistent hikes.

How Does the Repo Rate Impact Inflation?

The repo rate is a critical tool for the central bank to manage inflation.

- High Repo Rate: Reduces money flow in the economy, curbing inflation by making loans expensive.

- Low Repo Rate: Increases money flow, encouraging borrowing and spending, which can help boost the economy during a slowdown.

Malhotra emphasized that controlling inflation is essential for sustained growth and financial stability.

What Are the Economic Projections for 2025-26?

- Inflation Forecast: Inflation is expected to remain within the target range and gradually decrease.

- GDP Estimate: While specific GDP figures were not disclosed, the RBI acknowledged challenges in the global economy, indicating below-average global growth.

RBI Cuts Repo Rate: Expert Insights

Economists view the rate cut as a positive step toward supporting economic recovery and easing financial pressure on households. However, they caution that banks might take time to pass on the benefits to borrowers fully.

The RBI’s decision to cut the repo rate after five years is a strategic move to balance inflation control and economic recovery. Borrowers can look forward to cheaper loans and lower EMIs, while the government remains committed to achieving long-term financial stability.

Stay updated as banks implement these changes, potentially reshaping the borrowing landscape in the coming months.

Also read:

Has the Tariff War Heats Up? China counters Trump’s 10% with 15% – Who is Affected?