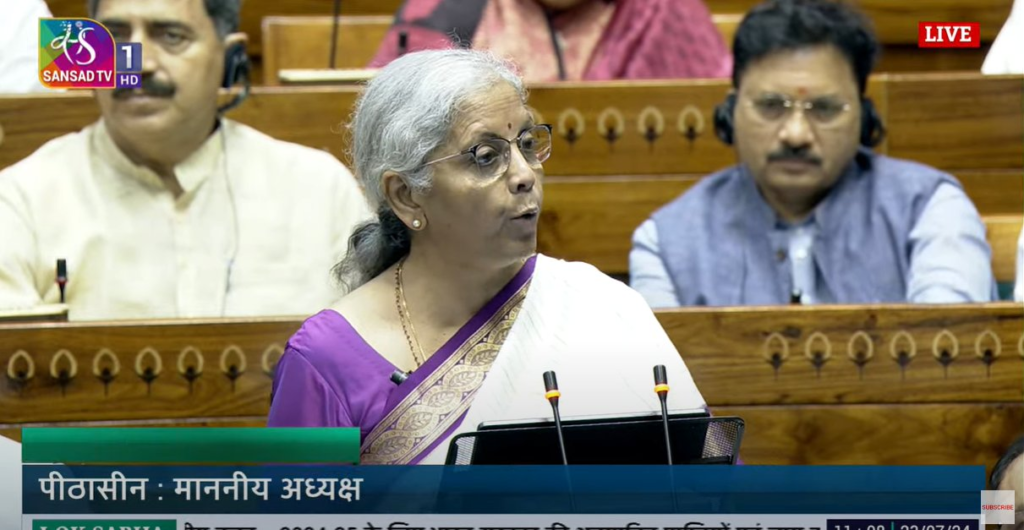

Union Budget 2024: Finance Minister Nirmala Sitharaman presented her seventh consecutive budget on Tuesday, July 23. Her 1 hour 23 minute speech brought some relief to the salaried class. For those who choose the new tax regime, income up to Rs 7.75 lakh has now become tax free. That is, they have benefited by Rs 17.5 thousand.

The Finance Minister announced a grant of Rs 58.9 thousand crores to Bihar and Rs 15 thousand crores to Andhra Pradesh. He also promised to bring a special scheme for infrastructure development for Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh.

Table of Contents

9 big things of the budget

1- What became cheaper in the budget: Cancer medicine, gold-silver, platinum, mobile phones, mobile chargers, electrical wires, X-ray machines, solar sets, leather and seafood. Custom duty on mobiles and chargers decreased to 15%. Custom duty on gold and silver jewellery decreased to 6%.

2- For salaried: In the new tax regime, income up to Rs 7.75 lakh is tax free, benefit of Rs 17.5 thousand. Tax exemption on family pension increased from Rs 15 thousand to Rs 25 thousand.

3- For those in their first job: If their salary is less than Rs 1 lakh, those registering for the first time with EPFO will get Rs 15,000 assistance in three instalments.

4- For education loan : Those who are not getting any benefit under government schemes will get loan for admission in institutions across the country. The government will give up to 3 percent of the loan amount. For this, e-vouchers will be introduced, which will be given to one lakh students every year.

5- For Bihar and Andhra Pradesh: Rs 58.9 thousand crores to Bihar and Rs 15 thousand crores to Andhra Pradesh. Special scheme for infrastructure development for Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh. Vishnupad Temple Corridor and Mahabodhi Temple Corridor will be built in Bihar. Nalanda University will be made a tourist center.

6- For farmers: Information of 6 crore farmers will be brought on land registry. New Kisan Credit Cards will be issued in 5 states.

7- For youth: Mudra loan amount increased from Rs 10 lakh to Rs 20 lakh. Promise of internship to 1 crore youth in 500 top companies.

8- For women and girls: Provision of Rs 3 lakh crore for schemes benefiting women and girls.

9- For Solar: Under Suryaghar Free Electricity Scheme, 1 crore households will get free electricity up to 300 units every month.

Highlights of Budget 2024-25

Key Pointers

• In this Budget, Govt has focused on employment, skilling, MSMEs, and the middle class. Prime Minister’s package of 5 schemes and initiatives for employment, skilling and other opportunities for 4.1 crore youth over a 5-year period with a central outlay of 2 lakh crore. This year, provision of ₹ 1.48 lakh crore has been made for education, employment and skilling. 1stScheme is for First Timers will provide one-month wage to all persons newly entering the workforce in all formal sectors.

2- 2ndSchemeis for Job Creation in manufacturing where an incentive will be provided at specified scale directly both to the employee and the employer with respect to their EPFO contribution in the first 4 years of employment

3- 3rdSchemewill cover additional employment in all sectors. All additional employment within a salary of ₹1 lakh per month will be counted. The government will reimburse to employers up to ₹ 3,000 per month for 2 years towards their EPFO contribution for each additional employee.

4- The 4th scheme under the Prime Minister’s package, for skilling in collaboration with state governments and Industry. 20 lakh youth will be skilled over a 5-year period.

5- 5th scheme under the Prime Minister’s package, government will launch a comprehensive scheme for providing Internship opportunities in 500 top companies to 1 crore youth in 5 years

– For helping our youth who have not been benefitted under any government initiatives, financial support for loans upto ₹ 10 lakh for higher education in domestic institutions will be provided.

E-vouchers for this purpose will be given directly to 1 lakh students every year for annual interest subvention of 3% of the loan amount.

– For promoting women-led development, the budget carries an allocation of more than ₹ 3 lakh crore for schemes benefitting women and girls.

– More than 100 branches of India Post Payment Bank will be set up in the North East region to expand the banking services.

– This year, a provision of ₹ 2.66 lakh crore for rural development including rural infrastructure has been made.

– The limit of Mudra loans will be enhanced to ₹ 20 lakh from the current ₹ 10 lakh for those entrepreneurs who have availed and successfully repaid previous loans under the ‘Tarun’ category.

– Govt will facilitate development of investment-ready “plug and play” industrial parks with complete infrastructure in or near 100 cities.

– 12 industrial parks under the National Industrial Corridor Development Programme also will be sanctioned.

– Phase IV of PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations which have become eligible in view of their population increase.

– To bolster the Indian start-up eco-system, boost the entrepreneurial spirit and support innovation, the so-called angel tax for all classes of investors has been abolished.

– Monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court has been increased to ₹ 60 lakh, ₹ 2 crore and ₹ 5 crore respectively.

– To improve social security benefits, deduction of expenditure by employers towards NPS is proposed to be increased from 10 to 14 % of the employee’s salary.

– Under the new tax regime. the standard deduction for salaried employees is proposed to be increased from ₹50,000/- to ₹75,000/-.

Similarly, deduction on family pension for pensioners is proposed to be enhanced from ₹ 15,000/- to ₹ 25,000/-. This will provide relief to about 4 crore salaried individuals and pensioners.

– As a result of these changes, a salaried employee in the new tax regime stands to save up to ₹ 17,500/- in income tax.

– Hon’ble Finance Minister Smt. Nirmala Sitharaman presented Budget FY 2024-25 on 23rd July, 2024.

– The people of India have reposed their faith in the government led by the Hon’ble Prime Minister Shri Narendra Modi and re-elected it for a historic third term under his leadership.

The Govt is determined to ensure that all Indians, regardless of religion, caste, gender and age, make substantial progress in realising their life goals and aspirations.

– The global economy, while performing better than expected, is still in the grip of policy uncertainties. Elevated asset prices, political uncertainties and shipping disruptions continue to pose significant downside risks for growth and upside risks to inflation.

– In this context, India’s economic growth continues to be the shining exception and will remain so in the years ahead.

India’s inflation continues to be low, stable and moving towards the 4 % target. Core inflation (non-food, non-fuel) currently is 3.1 %.

Steps are being taken to ensure supplies of perishable goods reach market adequately.

– As mentioned in the interim budget that the Govt will focus on 4 major castes, namely ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and ‘Annadata’ (Farmer).

– For Annadata, higher Minimum Support Prices a month ago for all major crops was announced, delivering on the promise of at least a 50 % margin over costs.

– Pradhan Mantri Garib Kalyan Anna Yojana was extended for five years, benefitting more than 80 crore people.

– Administrative actions for approval and implementation of various schemes announced in the interim budget are well underway. The required allocations have been made.

– This Year’s Budget particularly focuses on Employment, skilling, MSMEs and the middle class, while announcing measures for 9 priorities.

1) Productivity and resilience in Agriculture

2) Employment & Skilling

3) Inclusive Human Resource Development and Social Justice

4) Manufacturing & Services

5) Urban Development

6) Energy Security

7) Infrastructure

8) Innovation, Research & Development and

9) Next Generation Reforms

Finance Minister told which 9 areas were given special focus in Budget 2024

While presenting the budget, the Finance Minister said that the focus of the budget is on four castes – poor, women, youth and farmers. Along with this, focusing on 9 sectors in the finance budget, the Finance Minister said that the current budget will be remembered for special priorities. The Finance Minister said that the budget focuses on 9 sectors. In the budget speech, the Finance Minister said that India’s economy is continuously performing better. The global economy is performing better than expected. The Finance Minister said that India’s economic growth has been better.

Special focus on these 9 areas of the budget-

1 – Productivity and resilience in agriculture

2- Employment and skills

3- Inclusive human resource development and social justice

4- Manufacturing and services

5- Urban development

6- Energy security

7- Infrastructure

8- Innovation, research and development

9 -Next generation reforms

The Union Budget 2024-25 announced nine priorities to generate ample opportunities in the economy. These nine priorities include productivity, employment, social justice, urban development, energy security, infrastructure, innovation and reforms. Presenting her seventh consecutive budget, the Finance Minister said that the government is conducting a comprehensive research review to develop climate-friendly seeds.

One crore farmers will turn to natural farming

In the budget speech, the Finance Minister said that one crore farmers will turn to natural farming in the next two years. The minister said that vegetable production clusters will be promoted on a large scale to increase production. The government will release 109 new high-yielding, climate-friendly seeds for 32 agricultural and horticultural crops. Sitharaman said that the implementation of various schemes announced in the interim budget in February is still going on.

Special focus on the poor, women, youth and farmers

While presenting the budget, the Finance Minister said that inflation in India has been low, it is currently 3.1 percent. Inflation is constantly under control. Food items are also within reach in the country. As it was said in the interim budget that we want to focus on these four castes – the poor, women, youth and the farmers. A month ago, we have announced increased MSP on almost all major crops. Pradhan Mantri Garib Kalyan Anna Yojana is running to benefit more than 80 crore people.

Efforts to increase the income of farmers

Along with this, while reading the budget speech, the Finance Minister said that India is currently moving on the path of progress. Inflation in the country is low and stable. At the same time, efforts are being made to bring inflation to a level below four percent. Also, the Finance Minister said that efforts are being made to give at least 50 percent margin on cost to the farmers. PM Garib Kalyan has been extended for five years. Our focus is on employment, skills and youth.

Special focus on these 9 areas of the budget- FULL DETAIL

Read Also: