Success Story of Anil Agarwal : Anil Agarwal, founder and chairman of Vedanta Resources, often in the headlines. Last year was much talked about an agreement between Vedanta and Taiwanese company Foxconn. Actually Vedanta and Foxconn had signed an MoU (Memorandum of Understanding) with the Gujarat government. This MoU is for setting up a semiconductor and display FAB manufacturing facility.

Vedanta and Foxconn will set up the country’s first semiconductor plant in Gujarat with an investment of Rs 1.54 lakh crore. It was said that this will create one lakh employment opportunities. The proposed business of manufacturing semiconductors in Gujarat will be looked after by Vedanta’s holding company Volcan Investments Limited.

Traveled from Patna to London

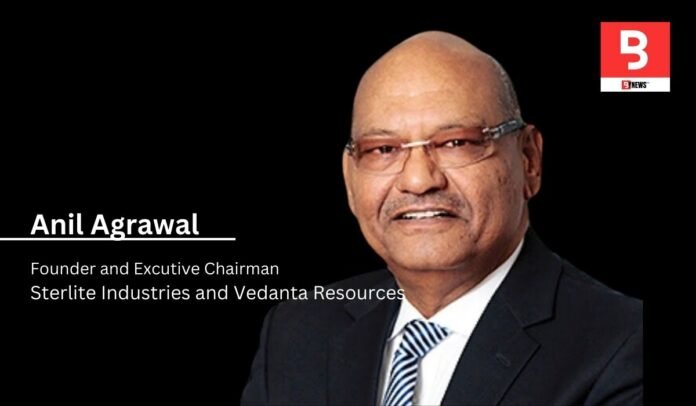

Anil Aggarwal is the Chairman and Founder of Vedanta Resources Limited. He controls Vedanta Resources through Volcano Investments. Anil is one of the giants of metal and mining business. Anil Aggarwal was born in 1954 in a Marwari family in Patna, Bihar. His father had a small business of aluminum conductors.

Anil studied from Miller High School, Patna. After this, instead of taking admission in university, he decided to help his father in business. At the age of 19, he moved to Mumbai to seek career opportunities. Anil Aggarwal had told through a series of tweets in May 2022 that when he left Bihar, he had a tiffin box and a bedspread in his hands and dreams in his eyes.

Start of business journey from scrap metal business

In the mid-1970s, Anil Aggarwal started his business journey by trading in scrap metal. He used to collect it from cable companies of other states and sell it in Mumbai. In 1976, Anil acquired Shamsher Sterling Corporation. This company also manufactured enameled copper along with other products and had a bank loan on it.

After this, Anil Aggarwal ran both the businesses for 10 years. In 1986, he set up a factory to make jelly filled cables and created Sterlite Industries. Anil Aggarwal soon realized that the profitability of his business was unstable, fluctuating with the prices of raw materials like copper and aluminium. Therefore, to control their input costs, they decided to manufacture metals instead of purchasing them.

Copper smelter and refinery established in 1993

In 1993, Sterlite Industries became the first private sector company in India to set up a copper smelter and refinery. In 1995, this company acquired Madras Aluminium, which was a sick company and was closed for 4 years. After this Anil Aggarwal thought of entering the field of mining. They got their first opportunity when the government announced the disinvestment programme.

In 2001, he acquired 51 percent in Bharat Aluminum Company i.e. BALCO. It was a public sector undertaking. The very next year he acquired majority stake (about 65%) in state-owned HZL (Hindustan Zinc Limited). Both companies were considered inefficient mining firms.

When did reach London?

After this, to access international capital markets, Anil Aggarwal and his team incorporated Vedanta Resources PLC in London in 2003. At the time of listing, Vedanta Resources PLC was the first Indian firm to be listed on the London Stock Exchange on 10 December 2003. In October 2018, Agarwal paid more than $ 1 billion for a third stake in Vedanta and after this Vedanta became a private company. Recently, Anil Aggarwal had told in a LinkedIn post that his initial months in Britain were full of difficulties. But he was excited for the new opportunities, but also nervous.

Vedanta Resources became the parent company of the group through a process of internal restructuring and shareholding of the group companies. Vedanta Resources is the largest mining and non-ferrous metals company in India.

Vedanta Resources is a globally diversified natural resources group with interests in zinc, lead, silver, copper, iron ore, aluminium, power generation and oil and gas. Vedanta Resources is headquartered in London, although the largest part of its assets are in India. Vedanta Limited, one of several Indian subsidiaries of Vedanta Resources, mines iron ore in Goa. Anil Agarwal owns the majority stake in India-listed Vedanta Limited.

Merger of Sesa Goa and Sterlite Industries in 2012

In 2004 Vedanta Resources PLC announced a global bond offering and acquired the Konkola Copper Mines in Zambia, Africa. In 2007, Vedanta Resources acquired a controlling stake in Sesa Goa Limited, the largest producer-exporter of iron ore in India. In 2010 the company acquired South African mining company Anglo American’s zinc assets portfolio in Namibia, Ireland and South Africa.

In 2011, Vedanta Resources acquired a controlling stake in Cairn India, India’s largest private sector oil producing firm. In 2012, the merger of Sesa Goa and Sterlite Industries was announced as part of the consolidation of the Vedanta Group. The old name of Vedanta Limited was Sesa Goa/Sterlite.

Vedanta Foundation established in 1992

In 1992, Anil Aggarwal established the Vedanta Foundation, with the help of which group companies could carry out their charitable programs and activities. In the financial year 2013-14, Vedanta Group companies and Vedanta Foundation invested $49 million in the construction of hospitals, schools and infrastructure, environmental protection and funding of community programs. Anil Aggarwal stood second in the Hurun India Philanthropy List of 2014 for his personal donation of Rs 1796 crore.

also surrounded in controversy

In 2004, a Supreme Court committee charged that Vedanta dumped thousands of tonnes of arsenic-bearing slag near its factory in Tamil Nadu. Due to this, a poisonous environment was created for the environment and the surrounding population.

In 2005, another Supreme Court committee charged that Vedanta forced more than 100 Indian families to leave their homes in Odisha, where it wanted to mine bauxite. The committee’s report said that the company created an atmosphere of fear with the help of goons and Vedanta employees even beat up the people living there.

Apart from this, the company was also involved in controversies in Zambia, when it came to light that Vedanta had dumped harmful waste from its copper mine into the Kafue River. 2000 residents filed a lawsuit in this regard.

Due to this activity of Vedanta, people fell ill and fish died. Apart from this, Thoothukudi violence is also noteworthy in Vedanta’s story. In March and April 2018, large-scale protests took place in Thoothukudi (Tuticorin) against the company’s plans to build a second smelting complex and demanding the closure of the existing Thoothukudi smelting plant.

It was being said that the company had violated environmental provisions. In May 2018, the protests became so intense that 13 people died and many others were injured after police shooting. Section 144 had to be imposed to control the situation. But the investigation did not find any concrete evidence regarding the role of Sterlite Industries in this case.

Real time net worth $2.3 billion

Anil Aggarwal is at number 728 in the Forbes list of billionaires for the year 2022. He was at number 63 in India’s Richest 2021 list. Anil Aggarwal is an Indian citizen but is based in London. In 2017, he bought 19 percent stake in London-listed mining company Anglo American through his family trust and sold it in 2019.

According to Forbes, at present the real time net worth of Anil Aggarwal and his family is 2.3 billion dollars. Aggarwal has also created a $10 billion fund in partnership with London-based company Centricus to invest in Indian public sector companies being made private.